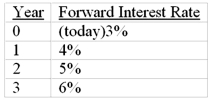

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the price of a 2-year maturity bond with a 5% coupon rate paid annually (Par value = $1,000.)

What is the price of a 2-year maturity bond with a 5% coupon rate paid annually (Par value = $1,000.)

A) $1,092.97

B) $1,054.24

C) $1,028.51

D) $1,073.34

E) None of the options

Correct Answer:

Verified

Q31: The following is a list of prices

Q32: Given the yield on a 3 year

Q32: The yield curve

A) is a graphical depiction

Q34: The on the run yield curve is

A)

Q36: Investors can use publicly available financial data

Q36: The following is a list of prices

Q37: The following is a list of prices

Q38: An upward sloping yield curve

A)may be an

Q39: When computing yield to maturity, the implicit

Q40: The yield curve is a component of

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents