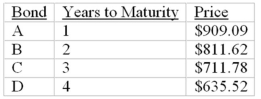

Consider the following $1,000 par value zero-coupon bonds:  The yield to maturity on bond C is

The yield to maturity on bond C is

A) 10%.

B) 11%.

C) 12%.

D) 14%.

E) None of the options

Correct Answer:

Verified

Q26: A coupon bond that pays interest semi-annually

Q53: You purchased an annual interest coupon bond

Q55: A Treasury bill with a par value

Q58: Consider the following $1,000 par value zero-coupon

Q59: A Treasury bill with a par value

Q61: The bond indenture includes

A)the coupon rate of

Q63: The process of retiring high-coupon debt and

Q64: TIPS are

A)securities formed from the coupon payments

Q65: A 12% coupon bond, semi-annual payments, is

Q70: A bond with a 12% coupon, 10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents