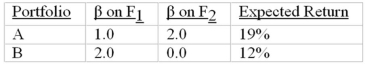

Consider the multifactor APT.There are two independent economic factors, F1 and F2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolio should be

A) 3%.

B) 4%.

C) 5%.

D) 6%.

Correct Answer:

Verified

Q22: There are three stocks: A, B, and

Q27: In terms of the risk/return relationship in

Q27: An important difference between CAPM and APT

Q29: The following factors might affect stock returns

A)the

Q30: Consider a one-factor economy.Portfolio A has a

Q30: A professional who searches for mispriced securities

Q31: Consider the one-factor APT. Assume that two

Q32: There are three stocks, A, B, and

Q36: The feature of the APT that offers

Q38: Advantage(s) of the APT is (are)

A) that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents