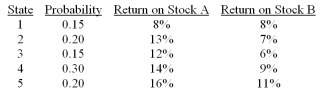

Consider the following probability distribution for stocks A and B:  If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation

If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation

A) 9.9%; 3%

B) 9.9%; 1.1%

C) 10%; 1.7%

D) 10%; 3%

Correct Answer:

Verified

Q47: When borrowing and lending at a risk-free

Q51: The line representing all combinations of portfolio

Q54: The risk that can be diversified away

Q59: Given an optimal risky portfolio with expected

Q59: The standard deviation of a two-asset portfolio

Q62: Theoretically, the standard deviation of a portfolio

Q63: Consider the following probability distribution for stocks

Q66: Security M has expected return of 17%

Q75: Consider two perfectly negatively correlated risky securities

Q76: Security X has expected return of 7%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents