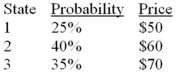

Toyota stock has the following probability distribution of expected prices one year from now:  If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota

If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota

A) 17.72%

B) 18.89%

C) 17.91%

D) 18.18%

Correct Answer:

Verified

Q20: You purchased a share of stock for

Q21: Which of the following factors would not

Q23: You have been given this probability distribution

Q28: A year ago, you invested $2,500 in

Q29: If the Federal Reserve lowers the discount

Q30: Over the past year, you earned a

Q31: An investor purchased a bond 45 days

Q33: A year ago, you invested $10,000 in

Q35: In words, the real rate of interest

Q39: "Bracket Creep" happens when

A) tax liabilities are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents