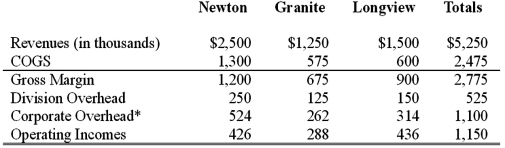

Performance of divisional managers at Leakproof Faucet Corporation is judged by an evaluation of the operating incomes of the divisions. Abbreviated income statements for the year ending 2013 are shown below for the three divisions of Leakproof Faucet Corp:

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

The manager of the Newton division, through increases in manufacturing efficiency, created some additional capacity in 2013. The only way he could have utilized this capacity would have been to manufacture a model J-5 faucet, which would have had the following impact on the Newton division:

Increase in annual revenues (in thousands) of $750.

Increase in cost of goods sold of $600.

Increase in divisional overhead of $100.

Mr. Garrett, the Newton division manager, chose not to manufacture the J-5 faucets; therefore, the additional capacity went unused.

Required:

(1) Prepare revised income statements for the three divisions for 2013 assuming that Mr. Garrett had chosen instead to utilize the additional capacity to manufacture the model J-5.

(2) Calculate the contribution margin of the Newton division if J-5 is manufactured and if it is not manufactured.

(3) Why did Mr. Garrett choose not to manufacture the J-5?

(4) Would Leakproof Faucets have benefited from the manufacture of the J-5?

(5) Identify an advantage and a disadvantage of not allocating any corporate overhead to the divisions.

Correct Answer:

Verified

Feedback:

(1)

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Brogdon is a ski instructor looking for

Q88: Lack of controllability is a disadvantage associated

Q91: The Harrison Bicycle Company had the

Q93: What is the tax effect on the

Q95: The Harrison Bicycle Company had the

Q103: Boating Inc. manufactures water vessels and is

Q104: Ginyard Company has the following financial statements

Q105: Wilson & Associates is a medium-size marketing

Q106: ) A leading author in accounting and

Q107: Corona is a privately held high-end luxury

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents