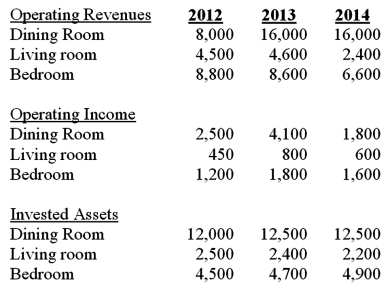

Products Inc. manufactures furniture and is organized into three large divisions: bedroom, living room, and dining room furniture. The following information presents operating revenues, operating incomes and invested assets of the company over the last three years. (all figures in 000s)

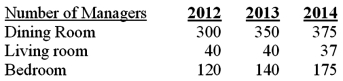

The following table shows the number of managers covered by the current compensation package of Products Inc.:

The following table shows the number of managers covered by the current compensation package of Products Inc.:  The current compensation package is an annual bonus award. The managers share in the bonus pool. The pool is calculated as 12% of the annual residual income of the company. The residual income is defined as operating income minus an interest charge of 10% of invested assets.

The current compensation package is an annual bonus award. The managers share in the bonus pool. The pool is calculated as 12% of the annual residual income of the company. The residual income is defined as operating income minus an interest charge of 10% of invested assets.

Required:

(1) Use investment turnover, return on sales, and ROI to explain the differences in profitability of the three divisions for 2012, 2013 and 2014.

(2) Compute the bonus amount to be paid during each year. Also, compute the average individual executive bonus amounts (round to even dollar).

(3) If the bonus were calculated by divisional residual income what would be the bonus amounts for each division?

(4) Discuss the benefits and problems of basing the bonus on residual income of a company compared to using divisional residual income.

Correct Answer:

Verified

Feedback:

(1)

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: There is a current tax for the

Q71: The King Mattress Company had the

Q82: Avantronics is a manufacturer of electronic components

Q83: Which of the following is a bonus

Q87: The Harrison Bicycle Company had the

Q88: Harold Small joined Morton Electric Company eight

Q90: The Harrison Bicycle Company had the

Q94: The Harrison Bicycle Company had the

Q97: Economic value added is a business unit's

Q98: Which of the following compensation plans would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents