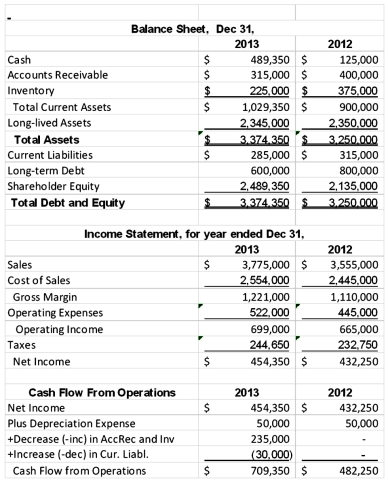

Jackson Manufacturing has the following operating results for 2013.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

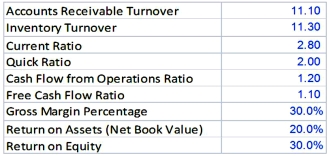

Exhibit A: Industry Ratios for the Jackson Company  Required:

Required:

1. Calculate the ratios In Exhibit A for Jackson Company for 2013, group them by category (liquidity, profitability) and develop a brief overview for the liquidity and profitability of the Jackson Company at the end of 2013.

2. Complete a Business Valuation for the Jackson Company based on 2013 financial statement information.

Correct Answer:

Verified

1. The ratios are shown ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: The Harrison Bicycle Company had the

Q93: What is the tax effect on the

Q100: Performance of divisional managers at Leakproof Faucet

Q103: Boating Inc. manufactures water vessels and is

Q103: Topaz Industries operates several large plants that

Q104: Ginyard Company has the following financial statements

Q104: Ruth's Chris Steak House is a chain

Q105: Wilson & Associates is a medium-size marketing

Q106: ) A leading author in accounting and

Q107: Corona is a privately held high-end luxury

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents