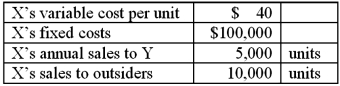

A company has two divisions, X and Y, each operated as an investment center. X charges Y $55 per unit for each unit transferred to Y. Other data are:  X is planning to raise its transfer price to $65 per unit. Division Y can purchase units at $50 each from outsiders, but doing so would idle X's facilities now committed to producing units for Y. Division X cannot increase its sales to outsiders. From the perspective of the short-term profit position of the company as a whole, from which source should Division Y acquire the units?

X is planning to raise its transfer price to $65 per unit. Division Y can purchase units at $50 each from outsiders, but doing so would idle X's facilities now committed to producing units for Y. Division X cannot increase its sales to outsiders. From the perspective of the short-term profit position of the company as a whole, from which source should Division Y acquire the units?

A) Outside vendors.

B) Division X, but only at the variable cost per unit.

C) Division X, but only until fixed costs are covered, then should purchase from outside vendors.

D) Division X, in spite of the increased transfer price.

E) It is not possible to tell without additional information.

Correct Answer:

Verified

Q61: The primary limitation of a full-cost based

Q63: Selected data from Division A of

Q66: Expropriation occurs when the government in which

Q67: The following results pertain to an

Q70: Selected data from Division A of

Q72: In the context of transfer pricing, dual

Q74: Given a competitive outside market for identical

Q75: Division A, which is operating at capacity,

Q76: One approach to measuring the short-term financial

Q78: Transfer prices based on actual costs of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents