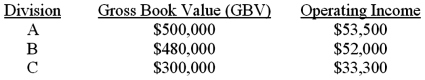

When the Bronx Company formed three divisions a year ago, the president told the division managers an annual bonus would be given to the most profitable division. The bonus would be based on either the return on investment (ROI) or residual income (RI) of the division. Investment is to be measured using gross book value (GBV) or net book value (NBV). The following data are available:

All the assets are long-lived assets that were purchased 15 years ago and have 15 years of useful life remaining. A zero terminal disposal price is predicted. Bronx's minimum rate of return (cost of capital) used for computing RI is 10%.

All the assets are long-lived assets that were purchased 15 years ago and have 15 years of useful life remaining. A zero terminal disposal price is predicted. Bronx's minimum rate of return (cost of capital) used for computing RI is 10%.

Required:

Which method for computing profitability would each manager likely choose? Show supporting calculations. Round percentage answers to 2 decimal places, e.g., 0.1234 as 12.34%. Where applicable, assume straight-line depreciation.

Correct Answer:

Verified

Feedback:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: The following questions pertain to the process

Q123: Max Ltd. produces kitchen tools, and operates

Q125: Assume the following facts regarding a product

Q126: What are the principal advantages and disadvantages

Q131: Domi Products, a multi-divisional manufacturing company, measures

Q131: T-shirts R Us Inc. operates two divisions

Q132: Simmons Bedding Company manufactures an array of

Q137: As noted in the text, the use

Q139: The text notes that there are various

Q139: Accounting records from Division A, Alpha Manufacturing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents