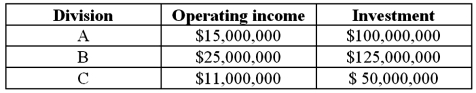

Meridian Investments has three divisions (A, B, C) organized for performance-evaluation purposes as investment centers. Each division's required rate of return for purposes of calculating residual income (RI) is 15%. Budgeted operating results for 2013 for each of the three divisions are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

1. Compute the current ROI for each division.

2. Compute the current residual income (RI) for each division.

3. Rank the divisions according to their current ROIs and residual incomes.

4. Determine the effects after adding the new project to each division's ROI and residual income (RI).

5. Assuming the managers are evaluated on either ROI or residual income (RI), which divisions are pleased with the expansion and which ones are unhappy? Explain briefly.

Correct Answer:

Verified

Feedback:

1. Division A ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: The manager of the processing division of

Q139: Accounting records from Division A, Alpha Manufacturing

Q141: A fellow student of yours who has

Q142: Assume two divisions of a company, P

Q143: The microprocessor division of Zenith Systems Company

Q146: Michael Cianci, manager of Division C of

Q147: The Division A of Standard Products is

Q148: This question pertains to factors affecting the

Q150: Pacific Mill consists of two operating divisions,

Q151: This question pertains to the use of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents