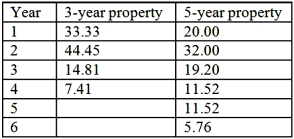

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine can produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's income tax rate is 40%. Management requires a minimum of 10% return on all investments. A partial MACRS depreciation table is reproduced below.  Required:

Required:

1. What is the estimated net present value of the investment (rounded to the nearest whole dollar)? (Note: PV $1 factors for 10% are as follows: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; the PV annuity factor for 10%, 5 years = 3.791.) Assume that all estimated cash flows occur at year-end.

2. What is the present value payback period (rounded to two decimal points)?

Correct Answer:

Verified

Feedback:

Question 1:

1....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: Six years ago, Nebrow Inc. purchased a

Q145: Omaha Plating Corporation is considering purchasing a

Q151: In capital budgeting, the profitability index (PI)

Q154: George's Garage is considering purchasing a machine

Q161: Slumber Company is considering two mutually exclusive

Q162: Nelson Inc. is considering the purchase of

Q164: Nelson Inc. is considering the purchase of

Q164: Kravitz Company is planning to acquire a

Q165: Fritz Company is planning to acquire a

Q167: Marc Corporation wants to purchase a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents