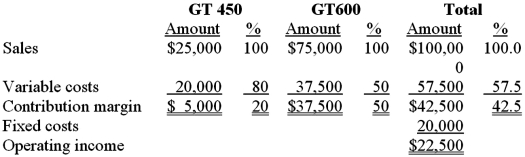

TexFab manufactures two products, GT450 and GT600 that have the following sales and cost information.  Required: Round all dollar answers up, to the nearest whole number.

Required: Round all dollar answers up, to the nearest whole number.

1. What is the breakeven point in dollars if sales remain at the same sales mix reflected in the income statement presented above?

2. If the TexFab Company's sales mix becomes $50,000 of product GT450 and $50,000 of product GT600, what is the breakeven point in sales dollars? Prepare an income statement-in the format given above-for this scenario.

3. Why have the breakeven point and the amount of operating income changed?

Correct Answer:

Verified

Feedback: 1. Sales mix p...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Income taxes have the following effect on

Q86: Effective use of the CVP (cost-volume-profit) model

Q89: Which of the following items is not

Q91: Daley Co. manufactures computer monitors. Following is

Q95: Firms A and B both produce and

Q96: The degree of operating leverage (DOL) at

Q97: Daley Co. manufactures computer monitors. Following is

Q99: New Hope Corporation manufactures replacement windshield wiper

Q99: Daley Co. manufactures computer monitors. Following is

Q102: The non-profit University Hospital is contemplating purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents