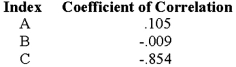

As a preliminary step in the selection of variables to use in a statistical-forecasting model, the management accountant has calculated the coefficient of correlation between the firm's sales and three economic indexes. The results were as follows:  Which of the following statements indicates the best course of action for the auditor to take in the development of a forecasting model?

Which of the following statements indicates the best course of action for the auditor to take in the development of a forecasting model?

A) Drop all three indexes from further consideration because a coefficient of correlation of + 1.0 is necessary for a statistically significant relationship.

B) Include only indexes B and C in the model because they have the only negative coefficients of correlation.

C) Include only index C in the model because its coefficient of correlation is relatively high and therefore probably statistically significant, while the coefficients of indexes A and B are likely to be insignificant.

D) Include only index A in the model because it has the only positive coefficient of correlation.

Correct Answer:

Verified

Q56: Jackson, Inc. is preparing a budget for

Q57: Which of the following is not a

Q57: A company allocates its variable factory overhead

Q58: Simple regression analysis involves the use of:

Q59: A manager uses regression to express sales

Q62: Which of the following is not usually

Q64: A range around the regression line within

Q68: The R-squared in a satisfactory regression should

Q72: Sterling Glass Company uses the high-low method

Q77: Bradford Company derived the following cost relationship

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents