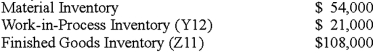

Rockingham Manufacturing Company builds highly sophisticated engine parts for cars competing in stock racing and drag racing. The company uses a normal costing system that applies factory overhead on the basis of direct labor-hours. For the current year the company estimated that it would incur $256,000 in factory overhead costs and 16,000 direct labor-hours. The April 1 balance in inventory accounts follow:  Job Y12 is the only job in process on April 1. The following transactions were recorded for the month of April:

Job Y12 is the only job in process on April 1. The following transactions were recorded for the month of April:

a. Purchased materials on account, $160,000

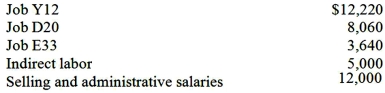

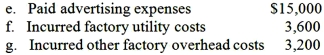

b. Issued $180,000 of materials to production, $6,000 of which was for indirect materials. Cost of direct materials issued:  c. Incurred and paid payroll cost of $40,920

c. Incurred and paid payroll cost of $40,920

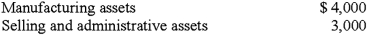

Direct labor cost ($20/hour; total 1,196 hours)  d. Recognize deprecation for the month:

d. Recognize deprecation for the month:

h. Applied factory overhead to production on the basis of direct labor-hours

h. Applied factory overhead to production on the basis of direct labor-hours

i. Completed Job Y12 during the month and transferred it to the finished goods warehouse

j. Sold Job Z11 on account for $120,000

k. Received $50,000 of collections on account from customers during the month

Required

(1) Calculate the company's predetermined overhead rate.

(2) Prepare journal entries for the April transactions. Record job-specific items in individual Work-in-Process accounts.

(3) What was the balance of the Materials Inventory account on April 30?

(4) What was the balance of the Work-in-Process Inventory control account on April 30?

(5) What was the amount of underapplied or overapplied overhead?

Correct Answer:

Verified

Feedback: 1. Predetermin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Horton Company uses a job costing system,

Q108: Powell Company uses a job costing system.

Q108: Amy and Jay Golden have worked for

Q109: Rivera Company manufactured two products, A and

Q111: Which method of accumulating product costs, job

Q114: Jones and Jones CPA firm has the

Q116: Chen Textile Company's Job A had normal

Q116: Boston Manufacturing Company had the following cost

Q117: Warren Company uses a predetermined overhead rate.

Q118: LM Company listed the following data for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents