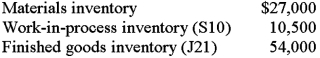

Humming Company manufactures high quality musical instruments for professional musicians. The company estimated that it would incur $120,000 in factory overhead costs and 8,000 direct labor-hours for the year. The April 1 balances in the inventory accounts follow:  Job S10 is the only job in process on April 1. The following transactions were recorded for the month of April.

Job S10 is the only job in process on April 1. The following transactions were recorded for the month of April.

a. Purchased materials on account, $90,000.

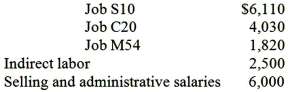

b. Issued $91,000 of materials to production, $4,000 of which was for indirect materials. Cost of direct materials issued:  c. Incurred and paid payroll cost of $20,460:

c. Incurred and paid payroll cost of $20,460:

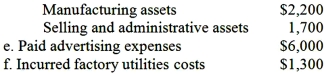

Direct labor cost ($13/hour; total 920 hours)  d. Recognized depreciation for the month:

d. Recognized depreciation for the month:  g. Incurred other factory overhead costs $1,600

g. Incurred other factory overhead costs $1,600

h. Applied factory overhead to production on the basis of direct labor-hours.

i. Completed Job S10 during the month and transferred it to the finished goods warehouse.

j. Sold Job J21 on account for $59,000.

k. Received $25,000 of collections on account from customers during the month.

Required:

1. Calculate the company's predetermined overhead rate.

2. Prepare journal entries for the April transactions. Letter your entries from a to k.

3. What was the balance of the Materials Inventory account on April 30?

4. What was the balance of the Work-in-Process Inventory account on April 30?

5. What was the amount of underapplied or overapplied overhead?

Correct Answer:

Verified

Feedback: 1.Predetermine...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: With the increase in competition over the

Q101: Harrison allocates factory overhead on the basis

Q103: Ramirez Company uses a predetermined overhead rate.

Q104: The following information is for Stier Company

Q105: Manufacturers of large equipment such as aircraft

Q106: Riverside Company manufactures two sizes of T-shirts,

Q107: Catlett Company manufactures products to customer specifications.

Q108: Powell Company uses a job costing system.

Q109: Rivera Company manufactured two products, A and

Q116: Chen Textile Company's Job A had normal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents