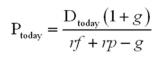

If a company reports that it is going to have a difficult time meeting its debt obligations, you would expect the Ptoday:

A) to fall since the risk-free return will rise.

B) to rise since the Dtoday will likely fall.

C) to fall since the risk premium will likely rise.

D) to remain about the same until the Dtoday actually changes.

Correct Answer:

Verified

Q27: A stock currently does not pay an

Q35: The Standard & Poor's 500 Index:

A) gives

Q36: A stock has a current annual dividend

Q37: People differ on the method by which

Q40: When comparing stock indexes around the world

Q42: A company currently pays a dividend of

Q45: Suppose that the current dividend for a

Q45: The basic dividend-discount model is a bit

Q49: The fact that many corporations use debt

Q56: The dividend-discount model predicts that stock prices:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents