Suppose there is a reduction of the return provided on U.S.Treasury bonds.We should expect the current price of stocks to:

A) increase since the risk-free return is now lower.

B) decrease since U.S.Treasury bonds are safer.

C) increase since the risk premium on the stocks will increase.

D) stay the same; there is no effect on stock prices from this reduction.

Correct Answer:

Verified

Q43: The theory of efficient markets implies:

A) stock

Q44: Consider the effect of business cycles on

Q48: Without the stockholders' limited liability, the risk

Q52: The theory of efficient markets assumes that:

A)

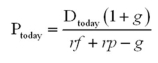

Q54: A company currently pays an annual dividend

Q57: As the corporation uses more debt financing,

Q58: In the event of bankruptcy, stockholders:

A) are

Q59: The required stock return an investor seeks

Q59: The impact from rapid dividend growth on

Q60: As a company issues more debt:

A) its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents