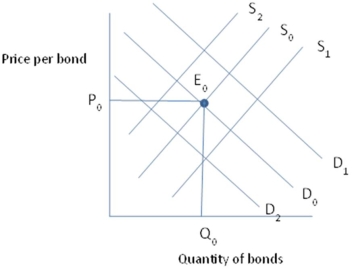

The market for bonds is initially described by the supply of bonds - S0, and the demand for bonds - D0, with the equilibrium price and quantity being P0 and Q0.If the U.S.government's borrowing needs decrease, all other factors constant:

A) Bond supply curve to shift to S1

B) Bond demand curve to shift to D1

C) Bond supply curve to shift to S2

D) Bond demand curve to shift to D2

Correct Answer:

Verified

Q82: Consider a zero-coupon bond with a $1,100

Q87: A student receives a five-year loan to

Q88: Default risk is the risk associated with:

A)

Q91: The market for bonds is initially described

Q91: Interest-rate risk results from:

A) bond prices being

Q93: The market for bonds is initially described

Q95: The market for bonds is initially described

Q96: Consider a one-year corporate bond that has

Q98: Interest-rate risk would not matter to which

Q114: Suppose that the interest rate on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents