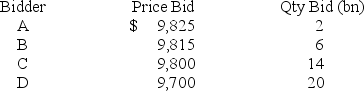

The Federal Reserve is offering Treasury bills with a par value of $40 billion for sale.They have received $18 billion of noncompetitive bids.The competitive bids for a $10,000 par value bond are:  How much money will the Federal Reserve raise from this offering?

How much money will the Federal Reserve raise from this offering?

A) $39.05 billion

B) $39.10 billion

C) $39.20 billion

D) $39.30 billion

E) $39.50 billion

Correct Answer:

Verified

Q82: The Federal Reserve is offering Treasury bills

Q83: A Treasury bond has a dollar price

Q84: A STRIPS that matures in 6 years

Q85: Municipal bonds are yielding 4.4 percent if

Q86: The Federal Reserve is offering Treasury bills

Q88: You own a principal STRIPS which is

Q89: A municipal bond is yielding 4.8 percent.Jeremy

Q90: You have a marginal tax rate of

Q91: A STRIPS has a $9,000 par value

Q92: A $1,000 Treasury note has 4.5 years

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents