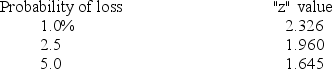

You have a portfolio which has an average return of 10.3 percent.In any given year,you have a 2.5 percent probability of earning either a zero or a negative annual return.What is the approximate standard deviation of your portfolio?

A) 5.26 percent

B) 6.43 percent

C) 6.94 percent

D) 7.60 percent

E) 8.14 percent

Correct Answer:

Verified

Q61: What is the Treynor ratio of a

Q62: A portfolio has a Jensen's alpha of

Q63: A portfolio has a standard deviation of

Q64: Lester has a portfolio with an average

Q65: A stock has a return of 16.9

Q67: Your portfolio has an expected annual return

Q68: What is Jensen's alpha of a portfolio

Q69: A portfolio has an average return of

Q70: Your portfolio has a standard deviation of

Q71: Angie owns a portfolio which has an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents