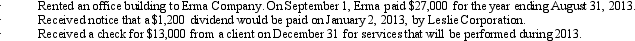

Nona Corporation, a calendar-year company, had the following transactions during 2012:  Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

A) $21,000

B) $27,000

C) $40,000

D) $41,200

Correct Answer:

Verified

Q4: A system of accounting in which revenues

Q5: A system of accounting in which revenues

Q6: The idea that a company's life can

Q7: In analyzing accounts to determine which adjusting

Q8: Under accrual-basis accounting, expenses are recognized

A) When

Q10: A twelve-month accounting period ending on December

Q11: Under accrual-basis accounting, revenues are always recognized

Q12: Which of the following are usually NOT

Q13: Which of the following is true about

Q14: Which of the following types of accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents