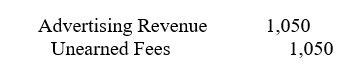

On June 1, 2013, Marino Corporation received $1,800 as advance payment for 12 months' advertising. The receipt was recorded as a credit to Unearned Fees. What adjusting entry is required at December 31, 2013?

A)

B)

C)

D)

Correct Answer:

Verified

Q39: Boudin Corporation, a calendar-year company, obtained a

Q40: Unrecognized interest expense on a note is

Q41: Kim Company purchased a two-year insurance policy

Q42: Garcia Company has received advance payment for

Q43: An unearned revenue account is usually considered

Q45: Amounts received before they are earned are

Q46: At the beginning of the period,

Q47: The original entry to record a prepaid

Q48: On December 16, 2012, Keen Company received

Q49: An adjusting entry to record the portion

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents