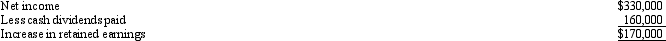

On January 1, 2012, Shane Corporation acquired 30 percent (13,000 shares) of Matthews Services Inc. common stock for $1,300,000 as a long-term investment. Data from Matthews's 2012 financial statements include the following:

The market value of Matthews Services Inc. common stock on December 31, 2012, was $98 per share. Shane does not have any other investments in securities.

Prepare the necessary journal entries for Shane's investment in Matthews Services Inc. common stock assuming Shane uses the following methods to account for its investment in Matthews Services:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: On January 2, 2011, Oakwood, Inc., purchased

Q80: Simpson Corporation purchased $30,000 of Tekservice Corporation's

Q81: Lexington Corporation purchased fifty $1,000, 12%, 5-year

Q82: Rentz Company held a bond investment with

Q83: In June 2012, Barwick Company had excess

Q84: Barry Inc. carries the following marketable equity

Q85: Johnson Company owns part of three different

Q87: Don Ono purchased Yoko bonds with a

Q88: In 2012, Vidalia had the following activities

Q89: Dixie Corporation recorded the following transactions for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents