Multiple Choice

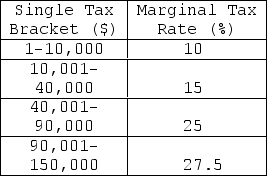

For a person earning $75,000,the marginal tax amount from 10,001 to $15,000 is:

For a person earning $75,000,the marginal tax amount from 10,001 to $15,000 is:

A) $500

B) $750

C) $1,750

D) $2,000

Correct Answer:

Verified

Related Questions

Q130: A tax on individuals' earnings is called

Q131: The American individual income tax is:

A) progressive.

B)

Q132: Corporate taxes in the US are:

A) regressive.

B)

Q133: The taxes used to pay for Social

Q134: The Social Security system pays:

A) current retirees

Q136: A tax on the income earned by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents