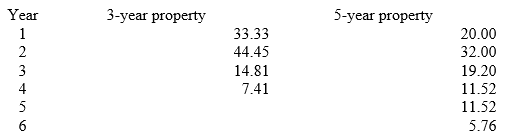

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered to be a 3-year property and is not expected to have any significant residual value at the end of its useful life. Marc's combined income tax rate, t, is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below. What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

A) $62,000.

B) $114,000.

C) $170,000.

D) $240,000.

E) $37,000.

Correct Answer:

Verified

Q56: If a company is in the situation

Q57: Without knowing its required rate of return

Q58: Cash-flow analysis: If an existing asset is

Q59: What is the present value of $1

Q60: Omaha Plating Corporation is considering purchasing a

Q62: Carmino Company is considering an investment

Q63: XYZ Corporation is contemplating the replacement of

Q64: Quip Corporation wants to purchase a new

Q65: Pique Corporation wants to purchase a new

Q66: Quip Corporation wants to purchase a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents