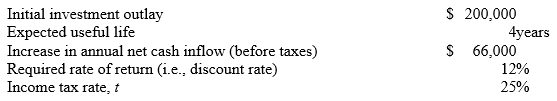

Harris Corporation provides the following data on a proposed capital project: Harris uses straight-line depreciation method with no salvage value.

Harris uses straight-line depreciation method with no salvage value.

Required:

Compute for the proposed investment project:

1. The project's estimated NPV (the PV annuity factor for 12%, 4 years is 3.037). Round your answer to nearest whole number (dollar).

2. The project's IRR (to the nearest tenth of a percent). Note: PV annuity factors for 4 years: @ 8% = 3.312; @ 9% = 3.240; @ 10% = 3.170; @ 11% = 3.102; @ 12% = 3.037; and, @ 13% = 2.974).

3. Payback period (assume that cash inflows occur evenly throughout the year); round answer to two decimal places (e.g., 4.459 years = 4.46 years, rounded).

4. Accounting rate of return (ARR) on the net initial investment, rounded to two decimal places (e.g., 10.4233% = 10.42%).

5. Discounted payback period (assume that the cash inflows occur evenly throughout the year; round your answer to 2 decimal places). The appropriate PV factors for 12% are as follows: year 1 = 0.893; year 2 = 0.797; year 3 = 0.712; year 4 = 0.636.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q150: Paulsen Inc. is considering the purchase of

Q151: In capital budgeting, the profitability index (PI)

Q152: The Zone Company is considering the purchase

Q153: Grey Inc. is considering purchasing a machine

Q154: George's Garage is considering purchasing a machine

Q156: Megan Inc. has a policy of not

Q157: Green Leaf Inc. is considering the purchase

Q158: Acorn Corporation designs and installs fire-suppression systems

Q159: Solich Company is evaluating a new tractor

Q160: A characteristic of the payback method is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents