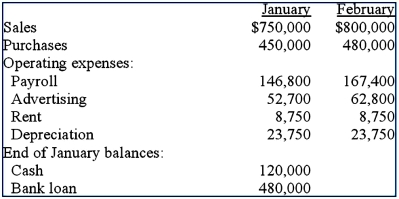

Olde Corporation is preparing a cash budget for the first two months of the coming year.The following data have been forecasted:  Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit.The term of credit sales is 2/10, n/30.The collection pattern for credit sales is 80% in the month following the month of sale (of which 75% are collected within 10 days), and 20% in the month thereafter.Total sales in December of the prior year were $1,000,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance the following month.

(3) Operating expenses are paid in the month incurred.

(4) The firm desires to maintain its cash balance at $150,000 at the end of each month.

(5) Loans are used to maintain the minimum cash balance.At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month.Repayments are made (at the end of the month) whenever the cash balance exceeds $150,000.

Required: Prepare the cash budget, in the form of a statement of cash flow, for February.What is the amount of the loan balance at the end of the month (after loan repayments, if any)?

Correct Answer:

Verified

Q123: As indicated in the text, sensitivity analysis

Q124: A business develops a budget for many

Q125: Grey Company is considering replacing its existing

Q126: In preparing a budget for the first

Q127: Papa Joe, Inc., is preparing its budget

Q129: Omni, Inc. manages a medical-expense reimbursement program

Q130: Enterprise Tax Services (ETS) provides tax planning.The

Q131: Information pertaining to Yeks Company's budgeted sales

Q132: Kurt Helfter graduated with a B.S. degree

Q133: The budget committee for Amacom Company, with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents