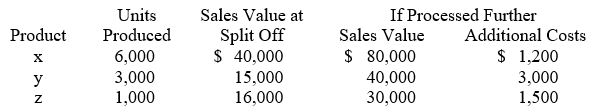

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Z using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Z using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

A) $12,000.

B) $32,000.

C) $36,000.

D) $48,000.

E) $72,000.

Correct Answer:

Verified

Q16: Which of the following methods considers all

Q17: Allocation of service department costs to producing

Q18: The reciprocal method can be solved using

Q19: If a budgeted activity base is used

Q20: The mathematical technique that underlies the reciprocal

Q22: Garrison Co. produces three products — X,

Q23: Garrison Co. produces three products — X,

Q24: Harmon Inc. produces joint products L, M,

Q25: Revenue methods of by-product cost allocation are

Q26: Harmon Inc. produces joint products L, M,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents