You are engaged in the audit of the December 31, 2013, financial statements of Epworth Products

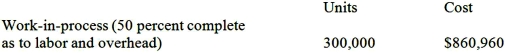

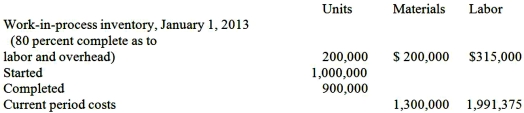

Corporation.You are attempting to verify the costing of the work-in-process and finished goods ending inventories that were recorded on Epworth's books as follows:  Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 60 percent of direct labor costs.Epworth uses the FIFO costing method.A review of Epworth's 2013 inventory cost records disclosed the following information:

Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 60 percent of direct labor costs.Epworth uses the FIFO costing method.A review of Epworth's 2013 inventory cost records disclosed the following information:  Required: Prepare a production cost report to verify the inventory balances.What is the amount of potential understatement or overstatement of the ending work-in-process account?

Required: Prepare a production cost report to verify the inventory balances.What is the amount of potential understatement or overstatement of the ending work-in-process account?

Correct Answer:

Verified

$504,000 = ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Transferred-in costs are costs of work performed:

A)In

Q97: The weighted-average method is most appropriate when:

A)Work

Q98: Many industries, for example mining and other

Q99: The U.S.Department of Agriculture urges the use

Q100: The following table was taken from

Q101: Atlantic Manufacturing Company uses process costing.All materials

Q102: Marshall Company uses the weighted-average process costing

Q104: NYI Corporation manufactures decorative window glass

Q105: Chen Manufacturing uses backflush costing.Chen has

Q106: DowntonTractor Company manufactures small tractors on an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents