John Brown and Alice Green want to start a business together.They will have equal ownership of the company.Alice would like to know whether a partnership or a corporation would be the best form of business (in her situation),strictly from a tax perspective.Alice would not take any form of payment from the company in the first year.

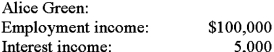

The following information is available for Alice.

Assume a constant tax rate of 41%.

Assume a constant tax rate of 41%.

A loss of $25,000 is anticipated for Year 1 of the business.

The corporate tax rate is 15%.

Required:

Based solely on minimizing Alice's Year 1's tax liability,which form of business will be most beneficial to Alice? Support your answer with calculations.

Correct Answer:

Verified

$105,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: ABC Co.and XYZ Co.have entered into a

Q2: Which of the following statements regarding partnerships

Q2: Small Corp.and Big Corp.are equal partners in

Q3: Green Co.and Blue Co.are equal partners in

Q4: Sharon is a forty percent partner in

Q5: Small Corp.and Big Corp.are equal partners in

Q8: Which of the following statements regarding partnerships

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents