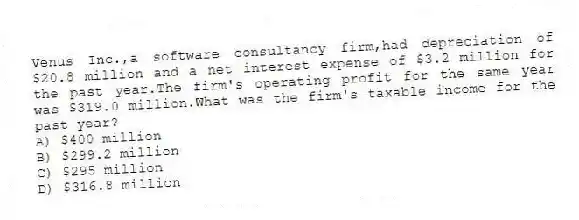

Venus Inc.,a software consultancy firm,had depreciation of $20.8 million and a net interest expense of $3.2 million for the past year.The firm's operating profit for the same year was $319.0 million.What was the firm's taxable income for the past year?

A) $400 million

B) $299.2 million

C) $295 million

D) $316.8 million

Correct Answer:

Verified

Q1: Receivables are collected credit sales.

Q5: Venus Inc.,a software consultancy firm,had made a

Q6: What is a markup? What are the

Q9: A balance sheet contains more marketing-related information

Q10: The difference between assets and liabilities of

Q11: The gross profit margin is the percentage

Q13: Subtracting depreciation and net interest expense from

Q15: Which of the following statements is true

Q16: Depreciation is an unusual expense because it

Q18: Explain the difference between an income statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents