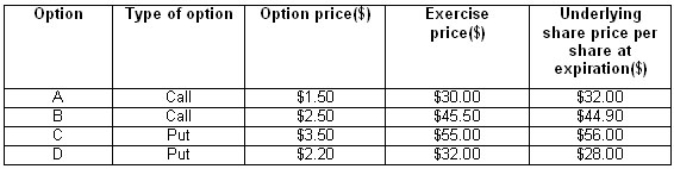

For each of the options shown in the following table,use the cost of underlying share price at expiration along with the other information to determine the amount of profit or loss an investor would have had,ignoring transaction/brokerage costs.

Correct Answer:

Verified

Q43: A call option can have a negative

Q44: Calculate the price of a two-month European

Q45: A convertible bond is an example of

Q46: The call price can be expected to

Q47: In most instances an American call option

Q49: A _ option provides the right,but not

Q50: The call price can be expected to

Q51: The _ model is a mathematical model

Q52: All things being equal,the more _ is

Q53: Calculate the price of a two-month European

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents