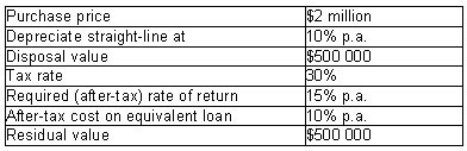

Aviation Ltd requires an aircraft for six years and is evaluating the following information:

What annual lease payments (made in advance) would make Aviation Ltd indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is as risky as the lease cash flows.

A) $523 772

B) $419 151

C) $498 229

D) $449 449

Correct Answer:

Verified

Q24: Shine Ltd is considering purchasing or leasing

Q25: Which of the following statements is not

Q26: One of the main reasons for firms

Q27: XYZ Ltd intends to lease to another

Q28: XYZ Ltd intends to lease to another

Q30: Tow Ltd plans to expand its fleet

Q31: An _ lease separates the risks of

Q32: Cancellable short-term operating leases are an attractive

Q33: Tow Ltd plans to expand its fleet

Q34: In the lease contract,the party that owns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents