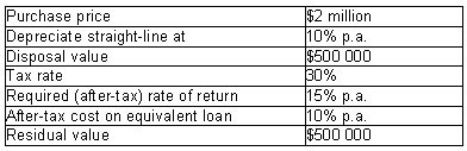

Aviation Ltd requires an aircraft for 6 years and is evaluating the following information:

What annual lease payments (made in advance) would make Aviation indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is riskier than the lease cash flows.

A) $422 698

B) $419 151

C) $432 910

D) $416 564

Correct Answer:

Verified

Q34: In the lease contract,the party that owns

Q35: Tow Ltd plans to expand its fleet

Q36: What is the rationale for analysing a

Q37: Which of the following statements is not

Q38: An essential feature of a commercial hire-purchase

Q40: Shine Ltd is considering purchasing or leasing

Q41: The default costs of a lease agreement

Q42: Chattel mortgages are treated in the same

Q43: In a perfect capital market,investors are _

Q44: Companies may seek to take advantage of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents