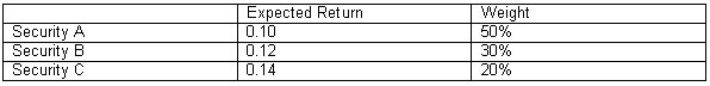

Calculate the expected return from a portfolio consisting of three securities with the following expected returns and weights:

A) 0.114%

B) 12%

C) 11.4%

D) 36%

Correct Answer:

Verified

Q31: Which of the following statements is true?

A)Two

Q32: Suppose you have the choice between two

Q33: According to portfolio theory,which of the following

Q34: Risk aversion implies that:

A)an investor will prefer

Q35: A risk-neutral investor attaches:

A)increasing utility to each

Q37: The variance of a portfolio does not

Q38: A risk-seeking investor attaches:

A)increasing utility to each

Q39: Suppose that the returns on an investment

Q40: Systematic risk represents:

A)diversifiable risk.

B)risk that is unavoidable.

C)risk

Q41: Which of the following is NOT a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents