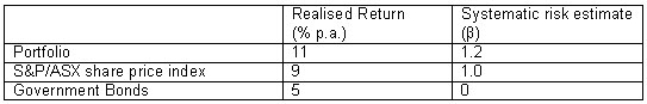

An investor would like to evaluate the performance of her portfolio using the Treynor ratio.The past year realised return and systematic risk of the portfolio,the benchmark portfolio,given by the S&P/ASX share price index,and government bonds are:

Has the portfolio:

A) underperformed relative to the benchmark.

B) outperformed the market benchmark on a risk-adjusted basis.

C) underperformed the market benchmark on a risk-adjusted basis.

D) outperformed the Government Bonds.

Correct Answer:

Verified

Q49: Fama and French (2002)use the dividend growth

Q50: Which of the following is not an

Q51: An investor would like to evaluate the

Q52: A popular measure of risk in corporate

Q53: Beta is a measure of the extent

Q55: Mehra and Prescott (1985)showed that a long-term

Q56: The _ is a curve that includes

Q57: From the following information,calculate the expected return

Q58: A risk _ investor will make their

Q59: Claus and Thomas (2001)use forecasts by security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents