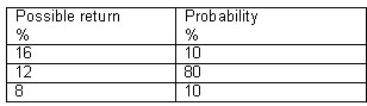

You are considering investing in ZIN mining corp.Research into the company suggests that the company will achieve one of three possible returns over the next 12 months.The possible returns along with the probability of each are listed in the following table.

a.What is the expected return of ZIN?

b.What is the standard deviation of returns of ZIN?

You also consider the stock WMC,which has an expected return of 15% and a standard deviation of 4%.If you create a portfolio with 60% weight on ZIN and 40% WMC and the correlation coefficient is 0.8,then:

c.What is the expected return of this portfolio?

d.What is the risk of the portfolio?

Correct Answer:

Verified

Q66: In order to benchmark the performance of

Q67: Explain the difference between systematic and unsystematic

Q68: Explain the key differences between the Capital

Q69: The typical utility-to-wealth function for a risk-seeking

Q70: Beta is calculated by finding the co-variance

Q71: The Fama-French three-factor model of expected returns

Q73: The Fama-French three-factor model of asset pricing

Q74: What are the two components of expected

Q75: The Capital Asset Pricing Model (CAPM)assumes that

Q76: An investor would like to evaluate the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents