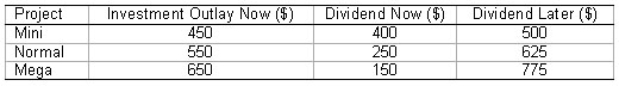

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period,and that the company has four equal shareholders (A,B,C and D) .Also assume the company has chosen Projects Normal and Mega for investment.Suppose Shareholder B wishes to consume $165 now.What is his required repayment in the later period?

A) $65

B) $165

C) $72.80

D) $184.80

Correct Answer:

Verified

Q16: Consider the following investment/dividend opportunities facing a

Q17: Under Fisher's separation theorem,the key factor that

Q18: The curve that displays the investment opportunities

Q19: The assumed overall financial objective of a

Q20: A company has $25 million in cash

Q22: Fisher's separation theorem means that:

A)a company can

Q23: Consider the following investment/dividend opportunities facing a

Q24: Consider the following production possibilities curve:

Q25: Fama (1970)outlines the sufficient conditions in order

Q26: Consider the following graph. ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents