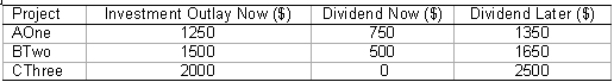

The AlhpaBeta company is considering considering several investment opportunities.The interest rate for both borrowing and lending is 15 per cent per period and the investment/dividend opportunities are given in the following table:

(a)What is the net present value of each project?

(b)Based on the NPV rule which project(s)should the company invest in?

(c)What is the IRR of project AOne?

(d)The company has 2 equal shareholders,Alpha and Beta,and invests in the project CThree.Alpha would prefer to consume $500 today.What can she do? How much will she be able to consume later?

Correct Answer:

Verified

Q46: The shape of the production possibilities curve

Q47: Consider the following diagram: Q48: In the absence of _ companies are Q49: Fisher's separation theorem has no implications for Q50: Fisher's separation theorem assumes markets have imperfections. Q51: If a project costs $700 and is Q52: An _ is a curve that shows Q53: The market opportunity line indicates the preferences Q55: Share prices change as a result of Q56: According to Fisher's Theorem,provided that the company![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents