Perry Investments bought 2,000 shares of Able, Inc. common stock on January 1, 2015, for $20,000 and 2,000 shares of Baker, Inc. common stock on July 1, 2015 for $24,000. Baker paid $2,400 of previously declared dividends to Perry on December 31, 2015. At the end of 2015, the market value of the Able stock was $18,000 and the market value of the Baker stock was $28,000. The stocks were purchased for short-term speculation. Perry owns 10% of each company.

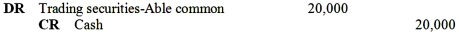

-The entry to record the purchase of Able,Inc.common stock would be

A)

B) DR Available-for-sale securities-Able common

CR Cash 20,000

C) DR Held to maturity securities-Able common 20,000

CR Cash 20,000

D) DR Cash 20,000

CR Available-for-sale securities

-Able common 20,000

Correct Answer:

Verified

Q70: The Kerry Company began operations during 2014

Q71: When an investor owns less than 20

Q72: Central Investments bought 4,000 shares of Benet

Q73: Perry Investments bought 2,000 shares of

Q74: When an investor is capable of influencing

Q76: Central Investments bought 4,000 shares of Benet

Q77: On January 1, 2015, Ramsey Company purchased

Q78: Perry Investments bought 2,000 shares of Able,

Q79: When the ownership percentage of stock exceeds

Q80: On January 1, 2015, Ramsey Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents