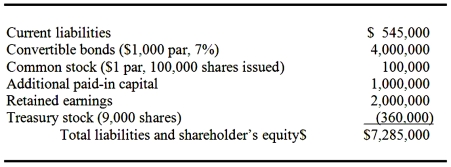

Prince Corp.has the following balance sheet information at December 31,2014.

The convertible bonds were issued at par on April 1,2014 and are convertible into Prince's common stock at a ratio of 25 shares of stock to 1 bond.Prince did not have any treasury stock at December 31,2013 and purchased the 9,000 shares evenly throughout 2014.The average price of the common stock for the year was $40,and the year end price was $45.

Prince Corp.also has 60,000 outstanding and exercisable qualified employee stock options.Employees obtain one share of stock for each option exercised.The exercise price for each option is $21 per share.

Prince's net income for the year ended 2014 was $292,500.Its tax rate for the year was 35%.

Required:

1.Compute basic EPS for the year ended December 31,2014.Show all computations.

2.Compute diluted EPS for the year ended December 31,2014.Show all computations.

Correct Answer:

Verified

Q101: Evert Company recently acquired 5,000 shares of

Q102: Cheery Company follows IFRS for its financial

Q103: Penn Company had 10,000,000 shares of common

Q104: To record newly issued stock shares upon

Q105: Which of the following correctly describes U.S.GAAP

Q107: The Sports Corporation previously issued convertible bonds

Q108: The Dunlop Corporation reported basic EPS of

Q109: The Slazenger Company has provided the following

Q110: Call provisions on convertible bonds protect the

A)investor

Q111: The Squash Company's shareholders' equity on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents