On January 2,2015,Cannon Company issued $10,000,000 of convertible debt.The bonds are zero-coupon,and each $1,000 bond is convertible into 10 shares of Cannon Company's common stock at the bond holder's option.The bonds mature in 2019 and were issued at par.Companies with similar credit profiles were issuing non-convertible debt at an effective rate of interest of 8%.The present value factor for $1 for 5 periods at 8% is .68058.For each of the following assumptions,prepare the journal entry to record the issuance of debt and entries for 2015 and 2016 to record interest expense.No bonds were converted during 2015 or 2016.

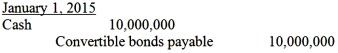

A.

No further entries would be required during 2015 and 2016 under U.S.GAAP.Current GAAP allows Cannon Company to avoid interest expense because the zero-coupon convertible debt and structure of the conversion feature allowed the company to sell the bond for par (face)value.Therefore,no interest expense is recorded over the life of the bond.

A.Cannon Company uses U.S.GAAP to prepare its external financial reporting to shareholders and regulators.

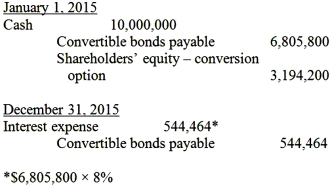

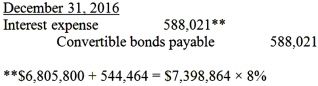

B.

B.Cannon Company uses IFRS to prepare its external financial reporting to shareholders and regulators.

Correct Answer:

Verified

No further entries would be require...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: The Sports Corporation previously issued convertible bonds

Q108: The Dunlop Corporation reported basic EPS of

Q109: The Slazenger Company has provided the following

Q110: Call provisions on convertible bonds protect the

A)investor

Q111: The Squash Company's shareholders' equity on January

Q112: Cheery Company follows IFRS for its financial

Q113: With the development of modern option pricing

Q114: Convertible bonds are usually

A)mortgage bonds.

B)senior bonds.

C)callable.

D)participating.

Q115: Cheery Company follows IFRS for its financial

Q117: Financial statement users must recognize that interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents