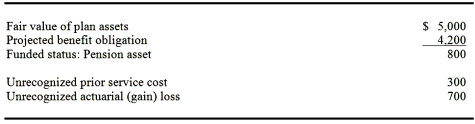

Krabby,Inc.had the following information at December 31,2014:

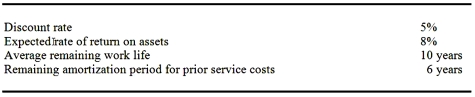

The following assumptions are being used for the pension plan in 2015:

You have the following additional information for 2015:

Required:

1.Compute pension expense for 2015.

2.Compute plan assets at December 31,2015.

3.Compute the projected benefit obligation at December 31,2015.

4.Compute Krabby's Unrecognized Actuarial (Gain)Loss at December 31,2015.

5.Compute the amount of the pension asset/liability that will appear on Krabby's December 31,2015 balance sheet.

Correct Answer:

Verified

\[\begin{array} { l r } ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Which of the following statements is correct?

A)Firms

Q100: Which of the following statements pertaining to

Q101: Differences between IFRS and U.S.GAAP in accounting

Q102: The Boulder Rock Company has provided the

Q103: The Shelast Corporation adopted a defined benefit

Q105: The income statement reporting for other postretirement

Q106: The following information pertains to Grumpy

Q107: Swan Company has provided you with the

Q108: Which of the following is not a

Q109: Which of the following is often not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents