Morey Corporation leases a tractor from Equity Leasing with a five-year non-cancelable lease on January 1, 2014 under the following terms:

1. Five payments of $26,379.74 (a 9% implicit rate, known to Morey) due at the end each year.

2. The payments were calculated based on the fair value (which is also the book value for Equity) of the tractor.

3. The lease is nonrenewable and the tractor reverts to Equity at the end of the lease term.

4. The tractor has a six-year economic life.

5. Morey has an excellent credit rating.

6. Equity offers no warranty on the tractor other than the manufacturer's two-year warranty that is handled directly with the manufacturer.

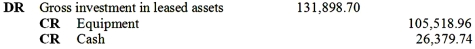

-Equity records this lease with which one of the following journal entries?

A) DR Gross investment in leased assets 131,898.70

CR Equipment 131,898.70

B) DR Gross investment in leased assets 131,898.70

CR Equipment 102,607.96

CR Unearned financing income-

Leases 29,290.74

C)

D)

Correct Answer:

Verified

Q78: Pepper, Inc. agrees to lease equipment

Q79: All of the following statements about residual

Q80: Pepper, Inc. agrees to lease equipment

Q81: On January 1,2014,Lessee Corporation entered into

Q82: Ford signs a non-cancelable 8-year equipment lease

Q84: On January 1,2014,Lessee Company entered into a

Q85: Morey Corporation leases a tractor from

Q86: Hatfield Corporation leases a tractor from

Q87: Hatfield Corporation leases a tractor from Star

Q88: Ford signs a non-cancelable 8-year equipment lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents