Morey Corporation leases a tractor from Equity Leasing with a five-year non-cancelable lease on January 1, 2014 under the following terms:

1. Five payments of $26,379.74 (a 9% implicit rate, known to Morey) due at the end each year.

2. The payments were calculated based on the fair value (which is also the book value for Equity) of the tractor.

3. The lease is nonrenewable and the tractor reverts to Equity at the end of the lease term.

4. The tractor has a six-year economic life.

5. Morey has an excellent credit rating.

6. Equity offers no warranty on the tractor other than the manufacturer's two-year warranty that is handled directly with the manufacturer.

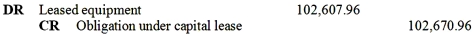

-Which of the following entries will Morey prepare to record the lease of the tractor on January 1,2014?

A)

B)

C) DR Leased equipment

CR Cash

D) DR Rent expense

CR Cash

Correct Answer:

Verified

Q80: Pepper, Inc. agrees to lease equipment

Q81: On January 1,2014,Lessee Corporation entered into

Q82: Ford signs a non-cancelable 8-year equipment lease

Q83: Morey Corporation leases a tractor from

Q84: On January 1,2014,Lessee Company entered into a

Q86: Hatfield Corporation leases a tractor from

Q87: Hatfield Corporation leases a tractor from Star

Q88: Ford signs a non-cancelable 8-year equipment lease

Q89: Morey Corporation leases a tractor from Equity

Q90: Morey Corporation leases a tractor from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents