Morey Corporation leases a tractor from Equity Leasing with a five-year non-cancelable lease on January 1, 2014 under the following terms:

1. Five payments of $26,379.74 (a 9% implicit rate, known to Morey) due at the end each year.

2. The payments were calculated based on the fair value (which is also the book value for Equity) of the tractor.

3. The lease is nonrenewable and the tractor reverts to Equity at the end of the lease term.

4. The tractor has a six-year economic life.

5. Morey has an excellent credit rating.

6. Equity offers no warranty on the tractor other than the manufacturer's two-year warranty that is handled directly with the manufacturer.

-With which of the following entries will Equity Leasing prepare to record the revenue earned on December 31,2014?

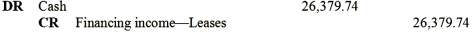

A)

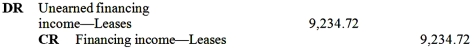

B)

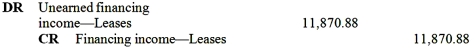

C)

D)

Correct Answer:

Verified

Q95: The difference in the lessor's income recognition

Q96: On January 1,2015,Lessor Corporation entered into a

Q97: GAAP defines lessors' treatment of leases according

Q98: Morey Corporation leases a tractor from Equity

Q99: Ford signs a non-cancelable 8-year equipment lease

Q101: On January 1,2015,Cole Corporation entered into a

Q102: If a company sells an asset for

Q103: On July 1,2015,Colby Company sold equipment to

Q104: Conroy Company leased equipment on January 1,2015.Information

Q105: Under IFRS

A)Disclosure of lessee future minimum lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents