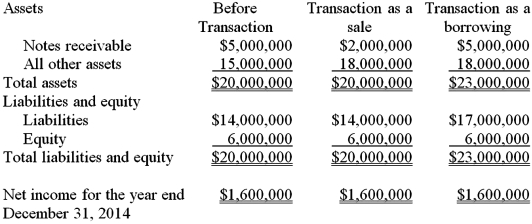

On December 31,2014,Barbie Bank securitized $3,000,000 of notes receivable using a securitization entity it had established.The cash received from the securitization entity was exactly $3,000,000,so it recognized no gain or loss on the transaction.Barbie Bank has the following account balances at December 31,2014 before the securitization was recorded:

Required:

a.Compute Barbie Bank's return-on-assets ratio and debt-to-equity ratio after completing this transaction assuming that the transaction was viewed as a sale under authoritative literature.

b.Compute Barbie Bank's return-on-assets ratio and debt-to-equity ratio after completing this transaction assuming that the transaction was viewed as a collateralized borrowing under authoritative literature.

The following table contains the data needed to compute the required ratios.

Correct Answer:

Verified

a.Return-on-assets ratio = $1,600,000 ÷...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: For the month of December 2014

Q134: Packwood,Inc.sells $250,000 of its accounts receivable to

Q135: On February 1,2014,Singer,Inc.received a $100,000,nine-month,10% interest-bearing note

Q136: If the present value interest factor for

Q137: On December 31,2014,Benton Company sold equipment to

Q138: The following information relates to Kay

Q139: Island Corporation owes Mutual Bank a 10%

Q140: Perez Company sold equipment to Gomez,receiving in

Q141: For sale of receivables without recourse,what is,if

Q143: Jensen Homes purchased $160,000 of scaffolding from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents