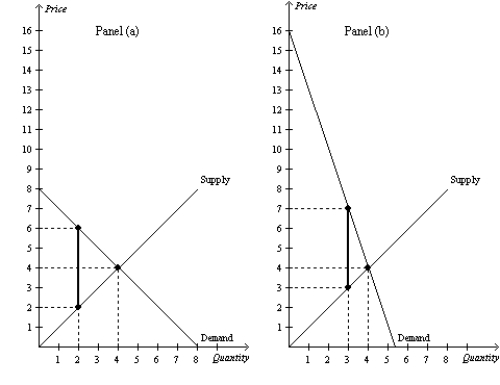

Figure 8-15

-Refer to Figure 8-15. Panel (a) and Panel (b) each illustrate a $4 tax placed on a market. In comparison to Panel (b) , Panel (a) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastid.

Correct Answer:

Verified

Q21: Assume the supply curve for cigars is

Q22: Suppose the government places a per-unit tax

Q37: Figure 8-14 Q41: The marginal tax rate on labor income Q49: Economists disagree on whether labor taxes cause Q56: Taxes on labor encourage all of the Q58: Concerning the labor market and taxes on Q59: The less freedom people are given to Q301: Taxes on labor have the effect of Q308: Figure 8-15![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents