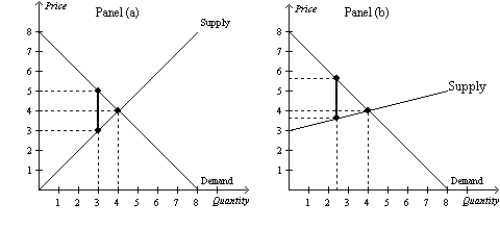

Figure 8-16

-Refer to Figure 8-16. Panel (a) and Panel (b) each illustrate a $2 tax placed on a market. In comparison to Panel (b) , Panel (a) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastid.

Correct Answer:

Verified

Q44: Which of the following is not correct?

A)Economists

Q45: As more people become self-employed,which allows them

Q47: Which of the following is a tax

Q50: Taxes on labor encourage which of the

Q51: Which of the following is a tax

Q60: Labor taxes may distort labor markets greatly

Q185: The Social Security tax is a tax

Q188: The less freedom young mothers have to

Q200: If the labor supply curve is very

Q309: Figure 8-16

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents